Stanislav Klika

Demand for sustainable businesses is rapidly increasing from investors, financial institutions, end customers and regulators. As a result, sourcing companies must take sufficient steps to ensure environmental and social sustainability.

BDO is ready to assist with ESG strategy setting, non-financial reporting and carbon neutrality action plans to ensure compliance with regulatory requirements.

BDO Audit is notified by ESMA, the European regulator and supervisor of financial markets, as an external verifier for green Eurobonds. The list of external verifiers for Green Eurobonds is available here.

The purpose of issuing green bonds is to finance and support "green projects" that aim to improve the environment. They are usually cheaper and more liquid for the issuer.

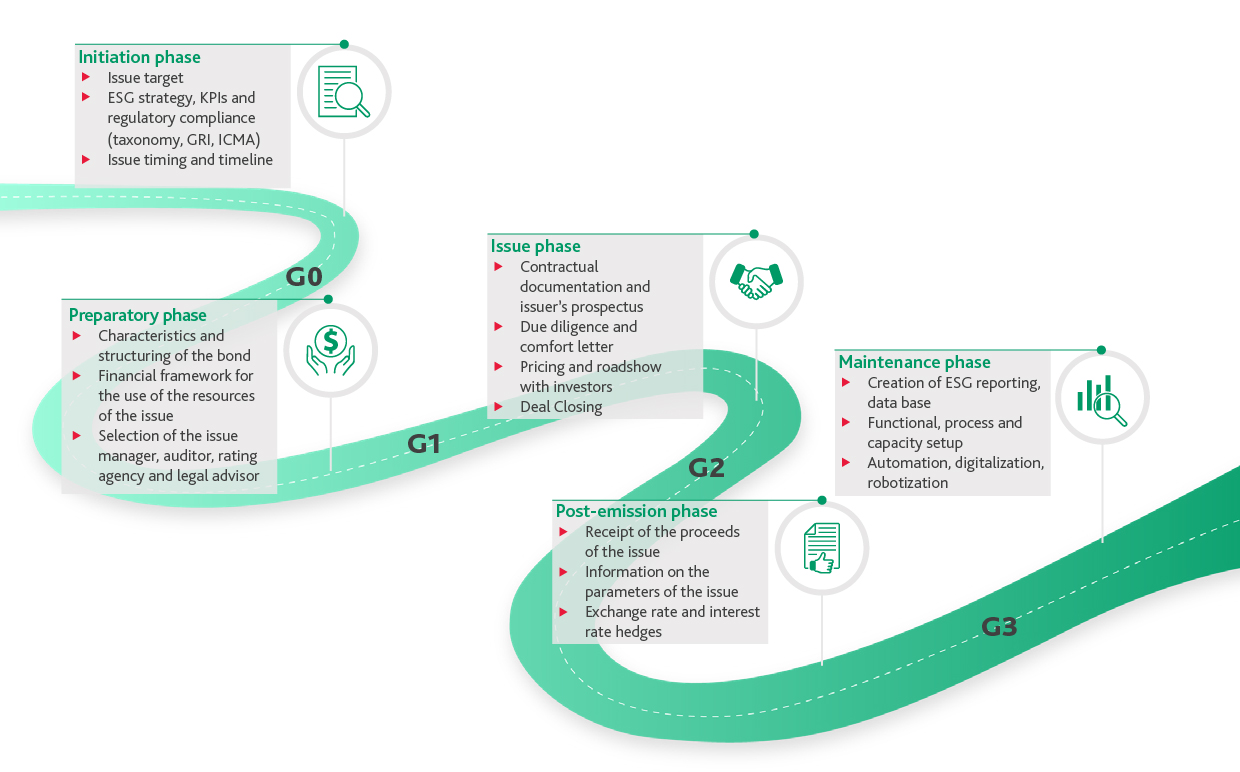

From BDO, you get a professionally managed process for a successful issuance, including support in setting and meeting challenging environmental or social goals.