Martin Hořický

The Council of the European Union formally adopted the Digital Operational Resilience Act (DORA) to ensure that digital infrastructure, including systems and networks that underpin critical services in the financial sector, is secure and resilient to potential threats.

Financial institutions have a relatively short time to comply with regulatory requirements. Their deadline starts on 16 January 2023, when the Digital Operational Resilience Act (DORA) came into force, and runs for two years.

Although the DORA regulation allows for a transition period until 17 January 2025, we recommend that organisations affected by the regulation start preparations immediately. We recommend that a phased approach is adopted, whereby entities in scope develop a DORA compliance programme with the aim of achieving compliance by the end of the transition period. Failure to achieve compliance may lead to severe penalties from January 2025.

EU Member States will have the right to impose sanctions for breaches of obligations. This means that the governing body can impose significant penalties for non-compliance. These significant penalties will take the form of a penalty of 1% of the average daily worldwide turnover of the organisation in the previous financial year. This penalty will be applied by the lead inspector on a daily basis until compliance is achieved and for a maximum of six months.

The Regulation applies to a number of EU regulated financial institutions, including credit institutions, payment institutions, securities dealers, insurance companies and others. It will also apply to ICT service providers.

This category includes e.g. cloud service providers, software, data centres. On the other hand, some operators of payment and credit card systems are exempted. In particular, micro-businesses (up to 10 persons with an annual turnover of less than €2 million) are granted significant relief from certain obligations. For example, they are not obliged to establish, maintain and review a so-called comprehensive programme of operational resilience testing of digital systems.

At BDO we offer services in the field of information and cyber security. We can help you secure your information and assets to minimize potential threats. We comply with other legislative requirements, in particular ISO standards and the Cyber Security Act (CSA).

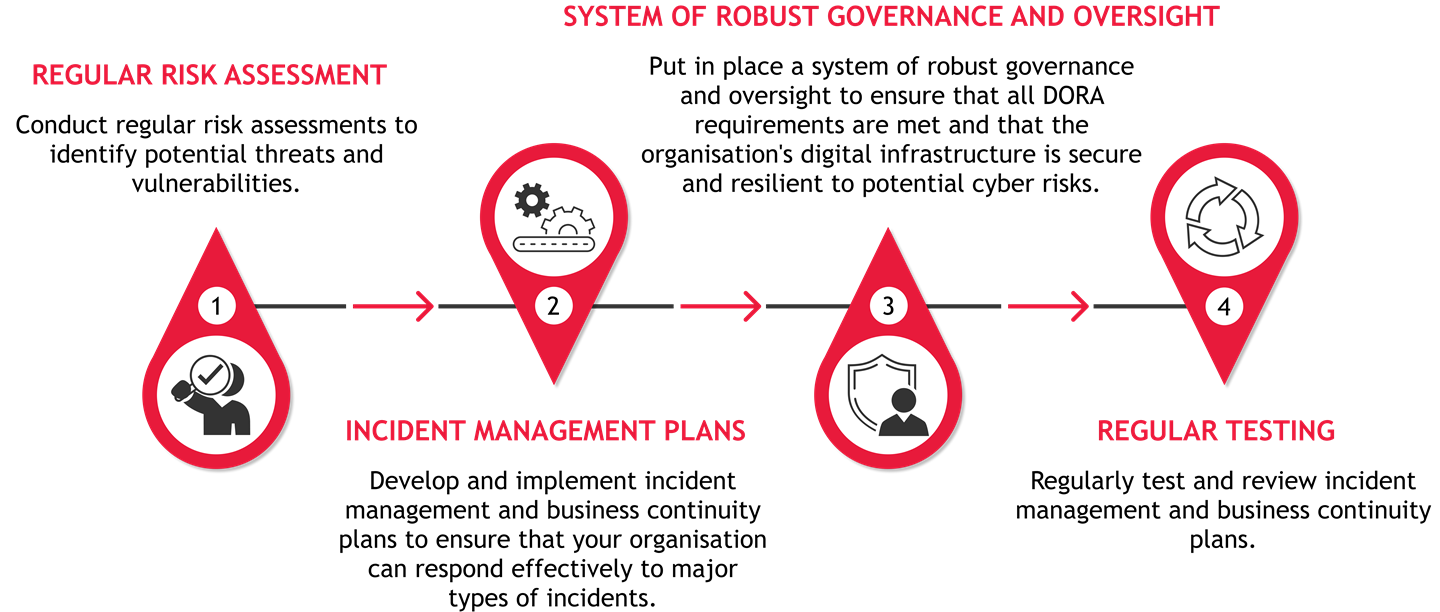

We provide expert advice on DORA compliance, including risk assessment and gap analysis, incident management, business continuity plans, cybersecurity, continuous support and monitoring.

We can also help you implement and provide services to ensure the security and resilience of your IT infrastructure against potential threats, including penetration testing, vulnerability assessment and incident response planning, and building a system to manage incidents.

We will train your staff to understand the purpose of DORA regulation and the principles of the measures in place. We will explain how they can play their part in helping to meet the requirements.