Interestingly, a large majority of companies surveyed (75%) already see ESG as a means of value creation, not just a box to tick to meet requirements, indicating that companies are increasingly aware that sustainable business practices can drive innovation and growth.

Sustainability is changing the business model

Almost all of the companies surveyed (97%) believe that sustainability will change their business model and impact their business activities, underlining the urgency to pay sufficient attention to ESG issues.

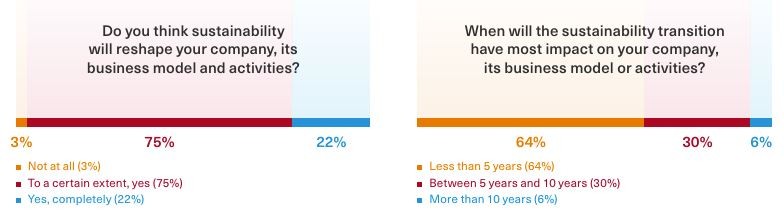

According to the survey results, 97% of respondents believe sustainability will change their business model and operations, with 22% saying it will completely change their company. In addition, the transition to sustainability is expected to have the greatest impact on companies' operations in less than 5 years (according to 64% of respondents). The main drivers of the sustainability transition are stakeholders (for 42% of respondents), new policies and legislation (30%), threats and opportunities (23%) and access to capital (1%). We can therefore conclude that sustainability is more than just a trend or buzzword. It is a long-term revolution that is gradually changing the face of businesses in all sectors.

To move forward on sustainability, companies should start a comprehensive process of progressive improvement.

Companies should build awareness, expertise and skills of their managers and employees on key sustainability topics. It is important to develop an ESG strategy, set priorities and name specific goals that the company wants to achieve. In order to verify that the strategy is correct and that the objectives are met within the expected timeframe, information on selected ESG indicators should be measured and published. It is essential to continuously review the chosen strategy and improve sustainability practices to meet evolving stakeholder expectations and regulatory requirements.

Taking ESG considerations into account in all dimensions of business can promote competitiveness and growth, create new opportunities and ensure that society is stable and resilient in the future. A sustainable approach helps to create value for both society and its stakeholders. Overall, adopting ESG principles will enable companies to seize new market opportunities, secure resources and conditions for their business, and ultimately improve their reputation.

Leaders must be the drivers

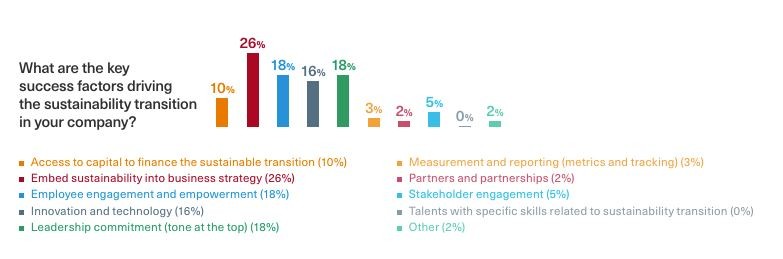

Incorporating ESG considerations into business strategy and selecting the right priorities enables companies to identify and manage risks, seize opportunities and create long-term value for all stakeholders.

A significant number of companies have already defined a sustainability strategy or are in the process of doing so. However, it is important to note that it is always essential to translate the ESG strategy into operational KPIs and to measure these systematically.

It is essential to involve company leaders in defining the strategy. Only they are able to anticipate and respond to evolving sustainability challenges, and their decisions and influence are critical to integrating sustainability into all aspects of the business.

To be able to perform their role well and also to inspire and motivate employees, they need to have sufficient knowledge and information about ESG.

How to get even more motivated?

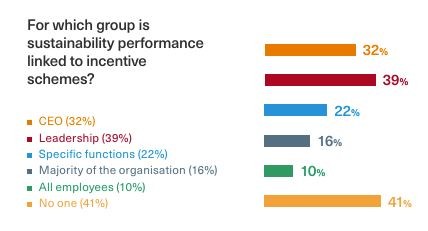

According to the survey, in a significant number of companies, ESG results are not linked to the incentive system. To ensure systematic implementation, we recommend linking a company's ESG performance to financial rewards for managers and employees and other motivators.

Linking ESG to employee incentive systems

No general assumption can be made about the choice of the most important ESG topics. It all depends on the context and the business sector. Therefore, a well-executed assessment of dual relevance is essential.

This assessment is based on two aspects:

- the impact that society has on people and the environment (impact materiality)

- the financial impact that ESG (environmental, social and governance) issues have on company performance (financial materiality)

The assessment of double materiality not only determines the scope of an organisation's sustainability reporting, but also provides valuable insights for shaping a company's strategy.

By identifying the parameters that are most important to the business and its stakeholders, companies can develop strategies that are aligned with their sustainability goals and create long-term value.

What did the survey also find?

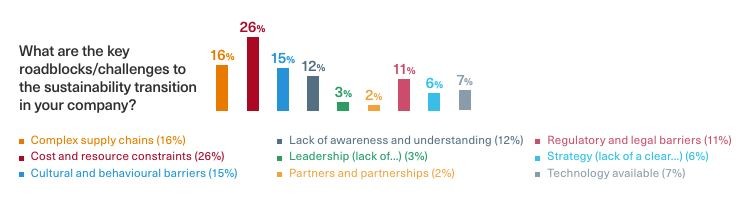

- The main barriers preventing companies from pursuing ESG include cost and resource constraints (26%), complex supply chains (16%), cultural and behavioural barriers (15%) and then lack of awareness and understanding (12%).

- Disclosure of ESG information is also becoming increasingly important. 60% of respondents already publish information on their ESG activities, 20% are currently preparing their first report and 18% plan to do so in the near future.

- Internal monitoring of ESG-related KPIs remains a significant challenge for many companies, as demonstrated by the fact that around 28% of unlisted large companies and 38% of SMEs have not yet translated their sustainability strategy into operational targets.

- Stakeholder expectations are growing. For example, the majority of companies (78%) have already received specific questions about sustainability from their clients. Existing or potential employees, investors or public authorities are also interested in the company's approach to sustainability.

- The stakeholders that are most pressuring companies to be more sustainable are customers (67%), public authorities/governments (50%) and existing or potential employees (51%). This finding is confirmed by the fact that respondents are already approaching these groups with specific questions about their approach to sustainability.

- For B2C companies, consumers are increasingly concerned about the sustainability of the products they buy. B2B companies are then raising expectations of their business partners as they need to ensure that their suppliers, subcontractors and providers comply with the high ESG standards set by legislation.

Why are companies embarking on the sustainability journey?

- Stakeholder pressure: higher expectations from different stakeholders such as clients, governments and employees are forcing companies to accelerate their sustainability efforts.

- Policies and legislation: new legislative requirements, such as the policies contained in the EU Green Deal and the Corporate Sustainability Reporting Directive, are pushing organisations towards more sustainable practices.

- Threats and opportunities: sustainability can both minimise risks and create new opportunities, as negative social or environmental impacts can cause reputational and financial losses, while sustainable products and services can increase the attractiveness of a company's offering and lead to higher margins.

- Access to capital: Companies with better ESG performance have easier access to finance. Investors are starting to favour sustainable organisations whose approach leads them to expect better results and higher valuations. They are also willing to give them better terms through better interest rates.

About the study:

The study "The ESG Imperative" was jointly conducted by BDO Belgium and Mercuri Urval in the following countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden and Switzerland. The study included a survey of companies to assess their attitudes towards sustainability, the obstacles they face and their main drivers. The research used a questionnaire methodology and an online survey conducted in November and December 2023 reached approximately 150 companies.

-> Download the study "The ESG Imperative"